Market volatility offers an opportunity to discuss a planning technique known as “tax-loss harvesting” which can be used to reduce taxes in certain cases. Tax-loss harvesting works by seeking to take advantage of investments that have declined in value, which is a common occurrence in broadly diversified portfolios. By selling investments that have declined below their purchase price, a tax-loss is generated, and that loss can be used to offset other taxable gains, thus lowering your potential tax liability.

Given the current market conditions, Freestone looks for opportunities to take advantage of tax-loss harvesting for our clients. A well-diversified portfolio of individual stocks can be ideal for tax-loss harvesting because various market sectors may perform differently in times of volatility. This planning opportunity provides losses to offset portfolio gains that may have been realized previously or in the future.

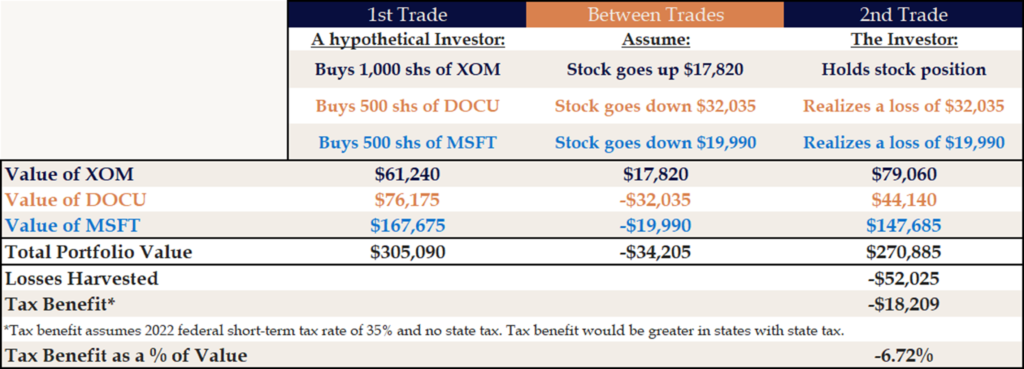

How does realizing the loss (selling the holding) benefit you? For illustrative and discussion purposes only, let’s look at a very simple example using just a three-stock portfolio. Assume that you purchase the following stocks on January 3rd of 2022:

- 1,000 shares of Exxon (XOM) at its opening price of $61.24 per share for a total investment of $61,240

- 500 shares of DocuSign (DOCU) at its opening price of $152.35 per share, for a total investment of $76,175

- 500 shares of Microsoft (MSFT) at its opening price of $335.35 per share, for a total investment of $167,675

Following these purchases, your total investment is $305,090.

On March 18th, 2022, your total value has dropped by a little over 11%, to $270,885. XOM opens at a price of $79.06, a 22.5% gain since you purchased it in January; you continue to hold these shares because the stock currently has an unrealized gain. Your DOCU and MSFT stocks, however, are both down, so you elect to sell those shares to take the losses. You sell all 500 shares of DOCU at its opening price of $88.28 per share for a total of $44,140, a short-term capital loss of $32,035. You also sell all 500 shares of MSFT at its opening price of $295.37 per share for a total of $147,685, a short-term capital loss of $19,990. This results in a total realized loss of $52,025, which can then be used to offset certain other gains.[1] If the applicable gains that year are less than the realized losses, you can “carry forward” the remainder of the loss into future years until it has all been used, allowing you to take full advantage of the loss. For example, an individual in the 35% tax bracket would be able to reduce his or her tax bill by roughly $18,209 if there were other short-term capital gains created in this tax year or in the future.

This sounds great from a tax perspective, but aren’t we supposed to “buy low and sell high?” Yes! We will want to stay invested as long-term investors, so tax-loss harvesting is best used as a tactic to enhance after-tax returns for taxable investors within a broadly diversified strategy. In order to keep the overall strategic allocation consistent, we can repurchase the same amount sold ($191,825 in total) in similar (but not identical) companies as placeholders. This approach is necessary to comply with the “wash-sale rule,” which requires an individual to be out of the original investment for 30 days for the losses to count for tax purposes. On day 31, we can sell the placeholder investment(s) and repurchase DOCU and MSFT at their new market prices. Let’s fast forward in a hypothetical scenario where we repurchase both DOCU and MSFT after 31 days. Bear in mind that there is no way to tell how the market will perform but, for purposes of our simple example, let’s assume the price of DOCU at the end of the year is $61.24 per share, and the price of MSFT is $335.35 per share. In this case, considering only price movement, you would have experienced a flat (albeit volatile) year of performance, but realized a significant tax benefit along the way.[2]

A few important caveats to note:

1. Tax-loss harvesting only applies to taxable accounts. Retirement accounts such as IRAs and 401(k)s, or 529s are already tax-sheltered and any investment held within these accounts are ineligible.

2. Tax-loss harvesting must be completed by Dec. 31st to utilize the tax loss for that year’s filing.

3. Long- and short-term capital gains rules still apply, so it’s worth reviewing all of your investments to determine what makes the most sense to sell.

4. If you are unable to offset recognized portfolio gains you are only allowed to claim a limited amount of losses on your taxes each year – $3,000 or $1,500 (married filing separately). Additional tax losses can be carried forward to use on future tax returns.

As with all tax items, certain restrictions apply and due to individual circumstances, all tax strategies may not be available or ideal for everyone. We are not making any investment or trading recommendations, and you should not take any action without first discussing with your Freestone advisor alongside a tax professional.

[1] Note that you may also incur other costs and expenses in connection with this activity, such as trading commissions. We have not included such items for purposes of this simple, illustrative example regarding the mechanics of tax-loss harvesting.

[2] The prices and performance cited in this document are not based on any current portfolio and used for illustrative purposes only.

Important Disclosures: Nothing in this article is intended to provide, and you should not rely upon it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any financial planning or tax planning strategy, and you should not make any financial planning or tax planning decisions based on the information in this article. This is not a recommendation to buy/sell any specific security. There is no guarantee any of these securities will be in your account. Securities listed in this article do not represent client’s entire portfolio. It should not be assumed any securities were or will be profitable or that future recommendations will be similar. The intention of this article is educational, and it is intended only to discuss a few limited aspects of a very complex tax planning strategy. This article is not a comprehensive or complete summary of considerations regarding its subject matter. Each individual is in a different situation and has different items to address, and the options in this article are not appropriate for everyone. Please consult your Freestone client advisor and a professional tax advisor regarding options specific to your needs.