There is a historical maxim attributed to Mark Twain which states that history doesn’t repeat itself, but it does rhyme.

In June, we celebrated the tenth anniversary of the Great Financial Crisis (GFC) and I want to look back at the last couple of financial meltdowns to see if there are any parallels today. Even though our recent experience has been one of booms and busts, financial crashes are actually uncommon throughout history. We just happened to have two of them over the last seventeen years. When humans are afflicted with recency biases; we tend to place more weight on events that occurred more recently. As a result, many investors continue to expect another financial crisis.

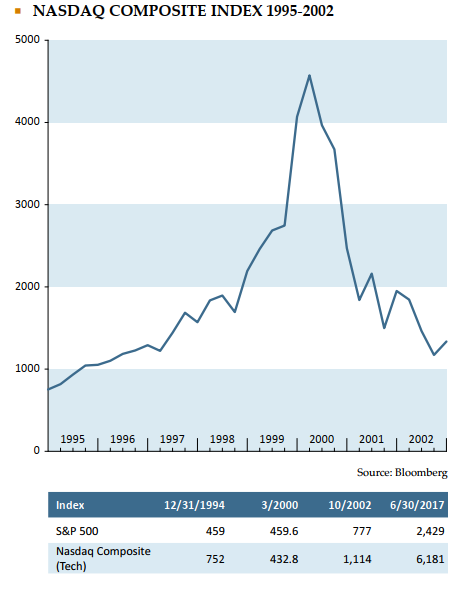

The Dot Com Crash: 2000 - 2002

Futurists turned out to be correct and maybe even understated when they predicted how much influence the internet was going to have on our economy and our lives. I try to explain to my kids what life was like before the internet and it is usually received with blank stares and comments like: “how did you get anything done” and “that sounds incredibly boring.”

In the early days of the internet, the futurists and media pundits believed that openness, public discourse, and transparency would turn out to be a good thing for society. It goes to show that predicting the future is never easy, even when it seems obvious. In the words of Twitter co-founder Evan Williams: “The trouble with the internet is that it rewards extremes. Say you’re driving down the road and see a car crash. Of course you look. Everyone looks. The internet interprets behavior like this to mean everyone is asking for car crashes, so it tries to supply them.” Today, 140 word “tweets” move markets and provide a platform for many (who should not have a platform) to express their opinions.

Wall Street invented new ways to evaluate companies since nearly all of the internet companies didn’t produce profits. Metrics like “market cap to clicks” became fashionable. Zapata, a fish oil manufacturer with a market value of $250mm announced an unsolicited bid for a search engine company, Excite (market value of $1.68 bln.) in 1998 and while the bid failed, it allowed Zapata to launch a search engine of their own called ZAP.com which eventually failed. The stock soared on the introduction of ZAP.com.

Valuations reached stratospheric levels with the S&P 500 trading at 48x earnings, people quit their jobs to day trade and IPOs boomed as a profitable business wasn’t a requirement to sell shares to the public. New phrases were invented to describe popular business strategies including “get big fast” and “get large or get lost.”

The aftermath was brutal. From 2000 to 2002, the tech heavy Nasdaq Composite index fell 78% and stalwart, good quality tech companies like Cisco fell 86%. Thousands of companies went bust including well-known companies Pets.com and Webvan. Out of the wreckage came some of the big winners of today including Amazon, Google (Alphabet) and Netflix.

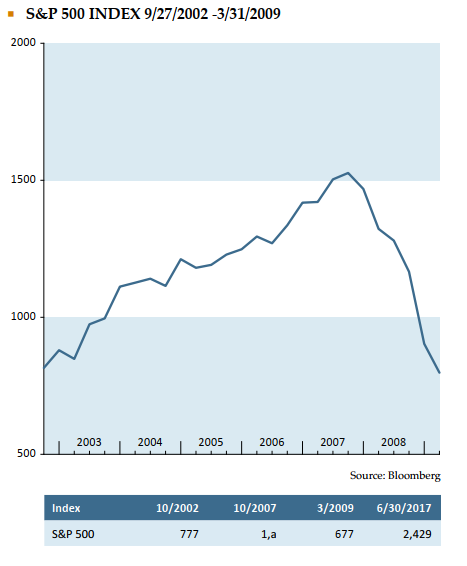

The Great Financial Crisis of 2007-2008 (GFC)

From the wreckage of the Dot Com Crash in 2002, U.S. stocks marched steadily upward fueled by easy monetary policy and declining interest rates. The real estate bubble was led by overeager mortgage lending and the adoption of various forms of subprime mortgages for borrowers with bad credit. The mortgage investors made one core assumption that ended up sinking the entire mortgage market – never in history had there been a widespread decline in home prices across the entire U.S. Well, this time it was different, and the bubble burst in June 2007 when two subprime mortgage funds managed by Bear Stearns imploded. This caused a chain reaction with global money markets unraveling in August 2007 and the Federal Reserve reversing course. In March 2008, Bear Stearns was forced to merge with JP Morgan Chase and in September 2008, Lehman Brothers imploded.

What About Now?

Based on my observations, most significant recessions and the related stock market declines are usually preceded by four conditions:

1. Federal Reserve tightening

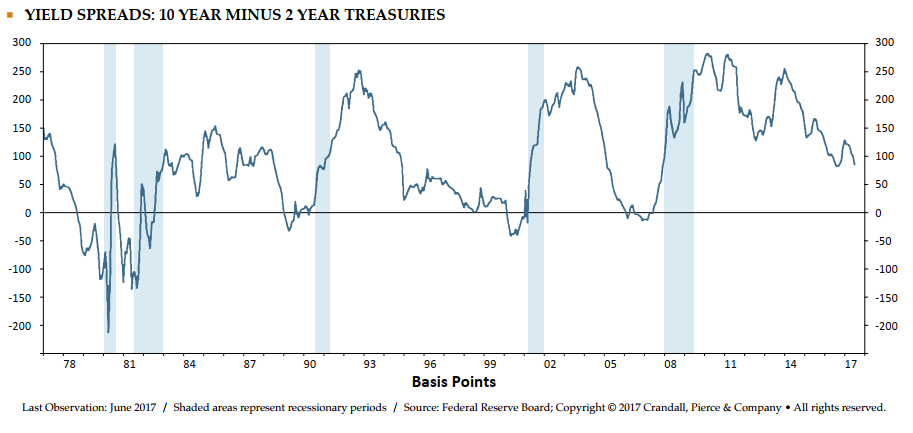

2. A negative yield curve (the difference between the 10 and 2 year treasury bond interest rate)

3. High asset valuations

4. Speculative investor behavior

- The Dot Com Crash was preceded by all four conditions

- The Great Financial Crisis was preceded by all four conditions

- We currently have the Federal Reserve tightening, speculative investor behavior and high asset valuations. We look to be on our way to having a negative yield curve. See the chart below:

The Federal Reserve started tightening monetary policy in December 2015. Asset valuations are high with the stock market selling at the second highest level in history behind the Dot Com Bubble valuations in 1998 and early 1999. There is speculative behavior taking place in various markets. Anyone who has looked at Seattle or San Francisco house prices can attest to speculative behavior and there have been other pockets of similar behavior in other popular urban real estate markets. Chinese investors paid a ridiculous $2 billion in 2015 for The Waldorf Astoria Hotel in New York city, IPOs with what appears to be very low probabilities of ever earning a profit have soared (Tesla and Snapchat), and a painting by Jean-Michel Basquiat sold for $110.5 million in May 2017, exceeding pre-auction estimates by $50 million. We have the FANG stocks (Facebook, Amazon, Netflix and Google) soaring with an average price earnings ratio of 88 on this year’s earnings. Speculation is evident.

Ultimately, predicting the future of stock prices is very difficult because history rarely repeats itself in exactly the same way as the previous cycle. At Freestone, our approach is to seek to invest across many asset classes in an effort to help cushion our clients when the inevitable downturns occur. We can’t predict with consistent accuracy what is going to happen in the near future, but based on studying history in time periods with similar conditions, we think we can detect a faint rhyming sound….

Important Disclosures: This article contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This article speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this article constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.